In excess of the many years, the stock of affordable residences has been in sharp decline, though property prices have risen significantly. With housing getting increasingly unaffordable, the shortage of risk-free and reasonably priced residences is influencing additional and a lot more prospective homebuyers every single day. Having said that, prospective impacts go further than person would-be home owners, with increasing implications for culture at large. This challenge has no just one solution, but with collaboration across the whole housing market, together we can make much more possibility for much more persons to accomplish sustainable, lengthy-expression homeownership.

Fannie Mae

Analysis demonstrates that profitable homeownership has many gains for the financial system. For example, we have observed that householders are far more probable to invest in their area’s financial state, get included in community federal government, and move on much more prosperity to their children. With ordinary wages increasing by only 16% considering the fact that 2012, and national home rates expanding by 47%, the effect on extensive-phrase, intergenerational financial very well-staying could be significant.

Fannie Mae

Only 31% of potential homebuyers, aged 25-34, are confident they will be equipped to locate a residence in their value assortment. In contrast with earlier generations, Millennials and Gen Z are getting into the market with larger amounts of debilitating debt. That, combined with the actuality that careers are typically concentrated in substantial-price tag areas, is delaying homebuying significantly. Additionally, the increase of COVID-19 also presents significant problems. In a the latest Fannie Mae survey, 40% of current renters report owning expert a potent impact on their in general economical wellbeing owing to the pandemic.

Fannie Mae

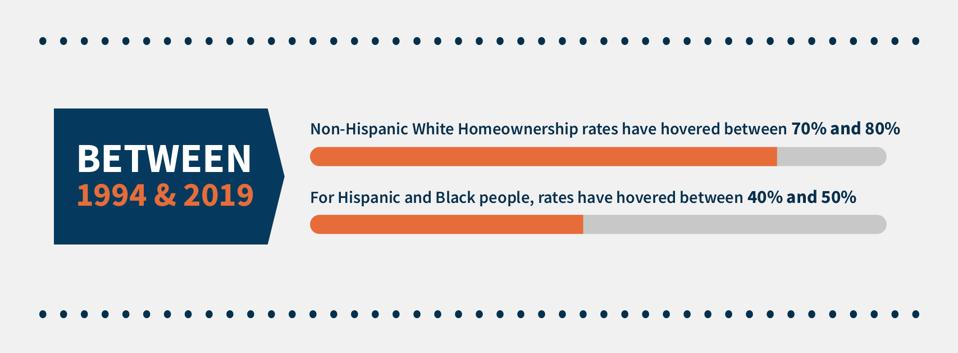

At the similar time, census reports plainly illustrate the incredibly true results of racial inequality in housing. In accordance to the U.S. Census Bureau, involving 1994 and 2019, Non-Hispanic White homeownership prices hovered involving 70% and 80%, though prices for Hispanic and Black persons remained between 40% and 50%. As Fannie Mae CEO Hugh Frater states, “Fannie Mae understands the story of housing in The united states incorporates a history of systemic racism, and we know our position in housing finance brings crucial duties.”

So, what can we do to assistance clear up these complications? Let’s share thoughts, begin conversations, and do the job together to make housing a lot more cost-effective.

Fannie Mae thinks that housing need to be attainable and sustainable for all. Which is why we’re committed to doing the job with our field companions and local community organizations driving this typical goal. Here’s our strategy:

Fannie Mae

See our infographic to study a lot more about why housing affordability matters.

/https://specials-images.forbesimg.com/imageserve/5f845bae3afc4a2bced86baa/0x0.jpg?cropX1=136&cropX2=1041&cropY1=0&cropY2=509)