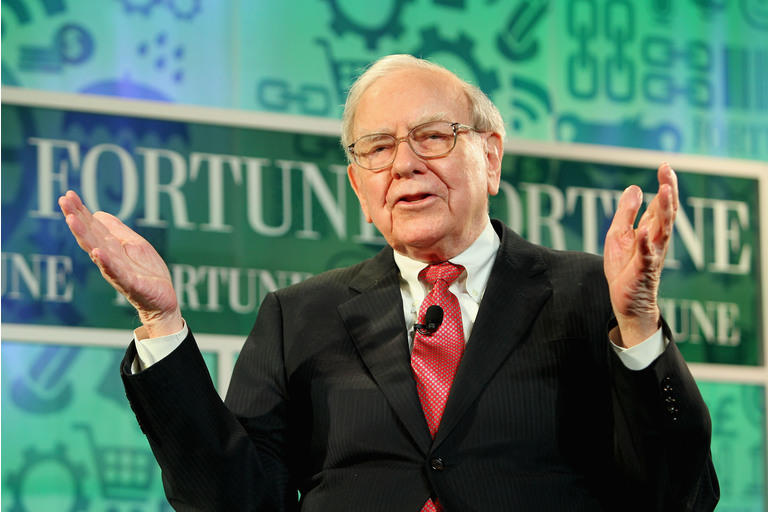

Warren Buffett is just one of the very number of buyers to have managed to compound returns at a 20% annual regular for much more than 50 many years.

Everyone can realize success over a 5-10 yr time interval, but the real exam is regardless of whether you can hold going for 10 years right after decade, and Warren Buffett’s Berkshire Hathaway (BRK.A) (BRK.B) is 1 of the uncommon exceptions to have reached that:

| Berkshire Hathaway | S&P 500 (SPY) | |

| Compounded Annual – 1964-2020 | 20.% | 10.2% |

| General Gain – 1965-2020 | 2,810,526% | 23,454% |

So, when he talks, we hear.

In modern posting, we glimpse nearer at his approach to genuine estate investing. Over the many years, he has generally reviewed why he seldom buys true estate, but extra lately, he has built large investments in the REIT sector (VNQ).

Down below we spotlight 5 causes why Warren Buffett favors REITs over non-public home investments:

Cause #1: No Competitive Benefit

In a shareholder meeting decades ago, Warren Buffett describes that they are not outfitted to contend with buyers who focus in serious estate investing.

The intriguing thing listed here is that back then Warren Buffett currently experienced invested hundreds of thousands into actual estate, had substantial resources via Berkshire, and Charlie had produced his preliminary fortune in genuine estate.

Even then, they felt that they couldn’t compete with REITs and other LPs that specialised in real estate investing and had an informational edge above them.

Below you ought to request you: If Warren and Charlie can’t compete in the genuine estate house, can you?

A good deal of unique traders imagine that soon after looking at a few YouTube videos and getting a authentic estate investing class from an on the net guru, they are effectively organized to turn out to be genuine estate traders.

In reality, most investors are overconfident and overestimate their skills. Warren Buffett is quite reasonable about his limits and understands that unless you are 100% focused on real estate, you might be unlikely to achieve very good effects investing in it.

Explanation #2: Lack of Mispricing

Somewhat connected to reason #1, if you are not totally focused to real estate, you are unlikely to find mispriced chances.

Warren Buffett clarifies that mispricings in authentic estate are exceptional. The industry is somewhat successful at pricing danger since most traders are extensive-time period oriented.

On the other hand, mispricings are far more regular in the inventory industry simply because most investors are limited-phrase-oriented and swift to panic when they see their stock decline in worth.

Warren believes that if you are an energetic trader, you are additional likely to come across better deals in the stock current market, including REITs, than in private genuine estate.

That is what he stated many years ago and it is effectively mirrored in modern marketplace.

Appropriate now, housing is purple warm, and industrial real estate is marketing at traditionally minimal cap rates. The prices mirror the extremely-minimal desire price atmosphere that we reside in.

Even then, the REIT sector is these days severely mispriced. Numerous REITs, like blue-chip names like W.P. Carey (WPC), Realty Earnings (O), and Countrywide Retail (NNN) are down by 20-30% even as their underlying properties are a lot more useful than ever right before.

That is a much better option.

Explanation #3: Corporate Tax Drawback

Berkshire Hathaway is structured as a company and it really is liable to corporate taxes.

Charlie and Warren clarify that this puts them at a key drawback relative to REITs, which are exempt from company taxes.

If you earn a 6% generate on a property, the REIT is left with 6%, but Berkshire is still left with a reduced financial gain owing to taxes.

Even then, Berkshire has built REIT investments, which are more tax efficient mainly because REITs only pay out out 50%-70% of their income movement in dividends, and the rest is retained at the REIT degree and not taxed. Furthermore, REITs have a larger development/appreciation ingredient than personal actual estate, which effects in lower corporate taxes.

Explanation #4: Administration And Scalability

In an job interview through the terrific economical crisis, Warren Buffett explains that if he had a way to effectively handle authentic estate, he would load up on single-family houses.

A ton of investors make the error of assuming that true estate is a passive investment when in reality it can be management intensive.

You are dealing with the dreaded 3 Ts: Tenants, toilets, and trash.

Could Warren Buffett employ the service of a home administration company? Sure, he could. In simple fact, he would get a substantially greater offer than you or me if he did that.

Having said that, the issue with home management providers is that their fees take in into your profitability, but even much more importantly, their interests are not aligned with yours. Obtaining a home and handing the keys to a residence manager is the equivalent of buying an externally-managed REIT, which we all know, is rarely a very good concept due to conflicts of desire.

With common REITs, Warren Buffett will get expert management that’s very well aligned with shareholders and enjoys sizeable economies of scale.

You also can very easily deploy money in a couple clicks of a mouse, which will make it simple to scale your investments above time.

Purpose #5: Prospects are in REITs Currently

Warren Buffett is a price investor.

He wishes to get significant-quality belongings at a discounted to truthful worth.

But as pointed out previously, the private authentic estate sector is currently purple sizzling. With the exception of a number of challenged sectors (place of work, malls, and many others.), you happen to be unlikely to obtain discounted possibilities. The desire for private actual estate is better than at any time in advance of due to the ultra-low interest fees.

Even then, a lot of REITs are currently priced at historically very low valuations, and not surprisingly, which is what Warren is obtaining. Below we spotlight a person of his preferred REITs:

Retail outlet Capital

Berkshire Hathaway 1st acquired shares of Store Money (STOR) back in 2017, and lately, they doubled down.

As a outcome, they now have nearly 10% of the fairness:

According to an interview of Chris Volk, CEO of Keep Capital, it truly is Warren Buffett that was driving this expenditure. You can skip to the 8:55 mark to discover much more about Warren Buffett’s financial investment in Store:

What is actually so particular about Retail store Money?

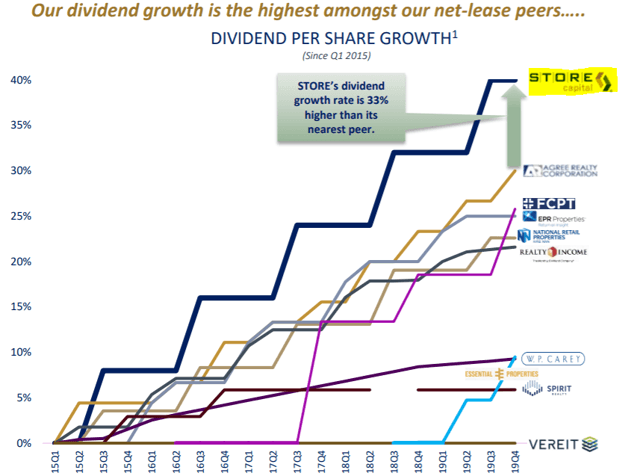

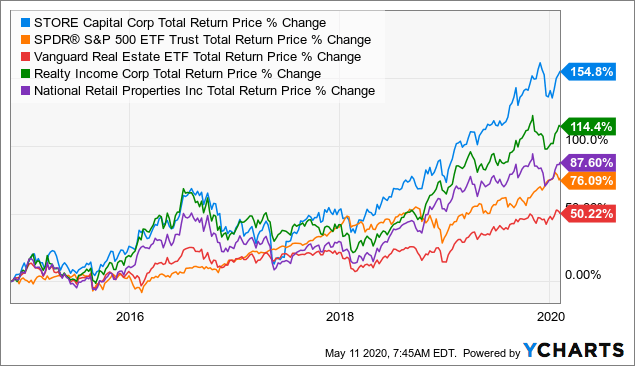

In shorter, STOR has a distinctive method that generates increased returns with decrease hazard than what Berkshire could achieve on its possess. We explore this method in detail in a separate report so we is not going to go into the specifics here, but its method has continuously led to important outperformance relative to its close peers, and this is very likely to go on significantly into the future:

Even then, STOR has been priced at an exceptionally minimal valuation around the earlier calendar year. It is even now ~15% reduced than prior to the pandemic, and that’s irrespective of climbing its dividend by 3% in 2020 and guiding for report-large income move in 2022.

You only can’t locate this style of prospect in the non-public real estate market and that is why Warren Buffett favors REIT investments.

Now, there are ~25 identical REIT chances in which we are investing at Significant Produce Landlord.